Inscrivez-vous au PU Xtrader Challenge dès aujourd’hui

Échangez avec du capital simulé et gagnez de vrais profits après avoir réussi notre évaluation de trader.

Inscrivez-vous au PU Xtrader Challenge dès aujourd’hui

Échangez avec du capital simulé et gagnez de vrais profits après avoir réussi notre évaluation de trader.

18 May 2023,06:01

Daily Market Analysis

President Biden is confident in reaching a bipartisan agreement with congressional leaders to elevate the debt ceiling, effectively averting an unprecedented default situation for the United States. This development has sparked a wave of optimism, prompting the dollar to trade higher, while the safe haven commodity gold languishes amid the surge in risk-on sentiment. Meanwhile, oil prices experience a boost on the back of President Biden’s encouraging news, buoyed above the $72 mark. On the other hand, Australia encountered an unexpected rise in its unemployment rate, marking the first such occurrence this year. This reinforces expectations that the Reserve Bank of Australia will maintain its current monetary policy stance, potentially leading to a depreciation of the Australian dollar.

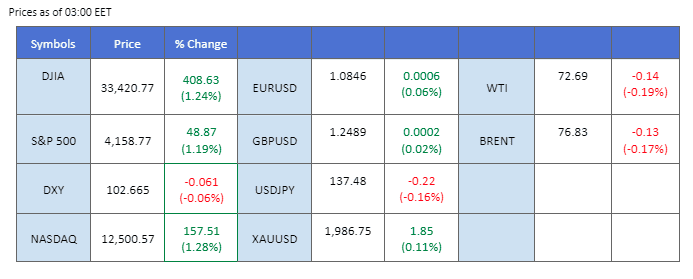

Current rate hike bets on 14th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (77%) VS 25 bps (23%)

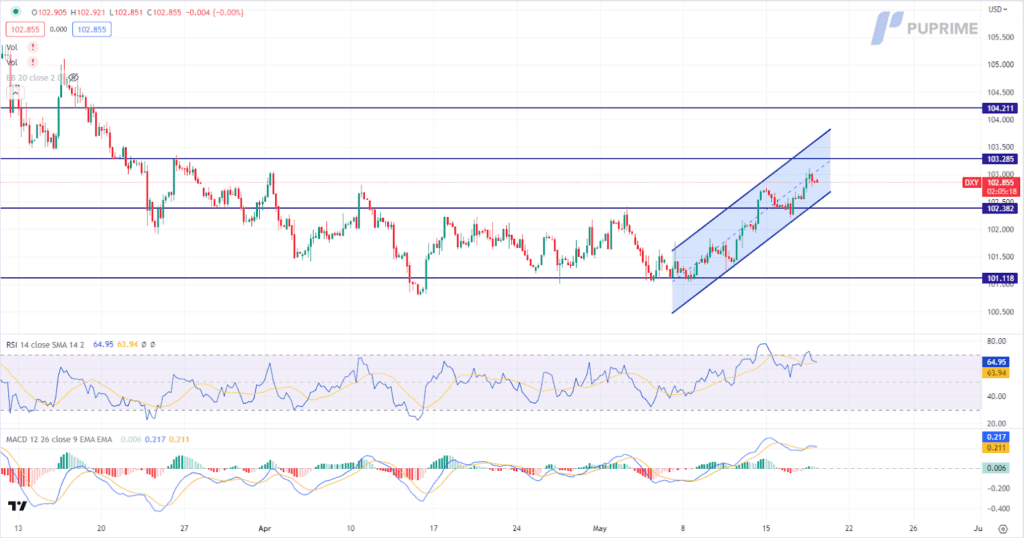

The Dollar Index, a measure of the U.S. dollar’s strength against a basket of major currencies, soared to a seven-week high, propelled by growing optimism surrounding a potential agreement to extend the debt ceiling and avert a disastrous default by the United States. President Joe Biden and leading congressional Republican Kevin McCarthy emphasized their unwavering commitment to swiftly reach a deal. President Biden unequivocally stated, “The leaders (of Congress) have all agreed: We will not default.”

The Dollar Index is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 65, suggesting the index might enter overbought territory.

Resistance level: 103.30, 104.20

Support level: 102.40, 101.10

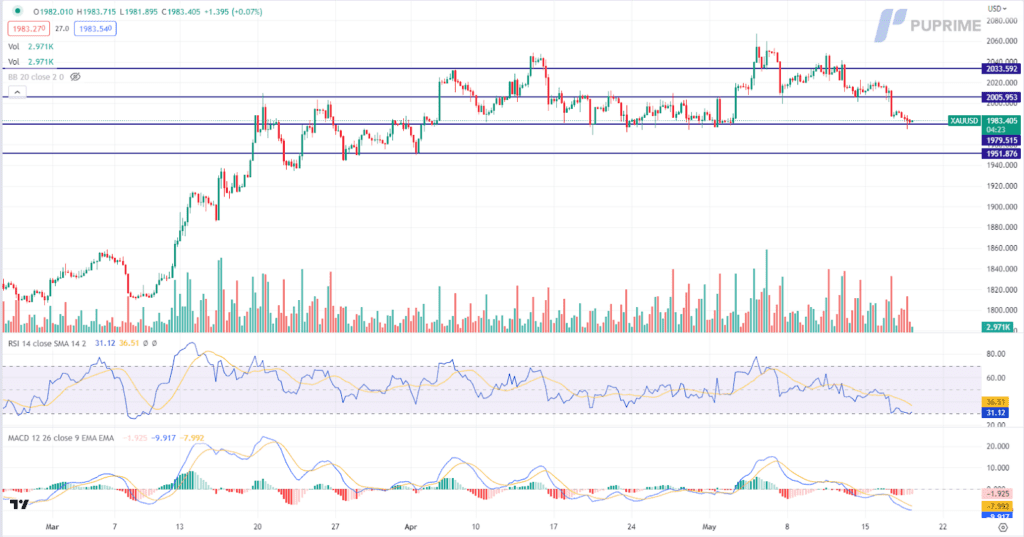

As the optimism surrounding a potential debt ceiling deal strengthens, the gold market continues to experience downward pressure, with investors shifting their sentiment towards riskier assets. The unwavering commitment expressed by President Joe Biden and leading congressional Republican Kevin McCarthy to promptly reach a resolution has instilled confidence in market participants. President Biden’s reassurance that the government will not default has further bolstered this positive outlook.

Gold prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the commodity might enter oversold territory.

Resistance level: 2005.00, 2035.00

Support level: 1980.00, 1950.00

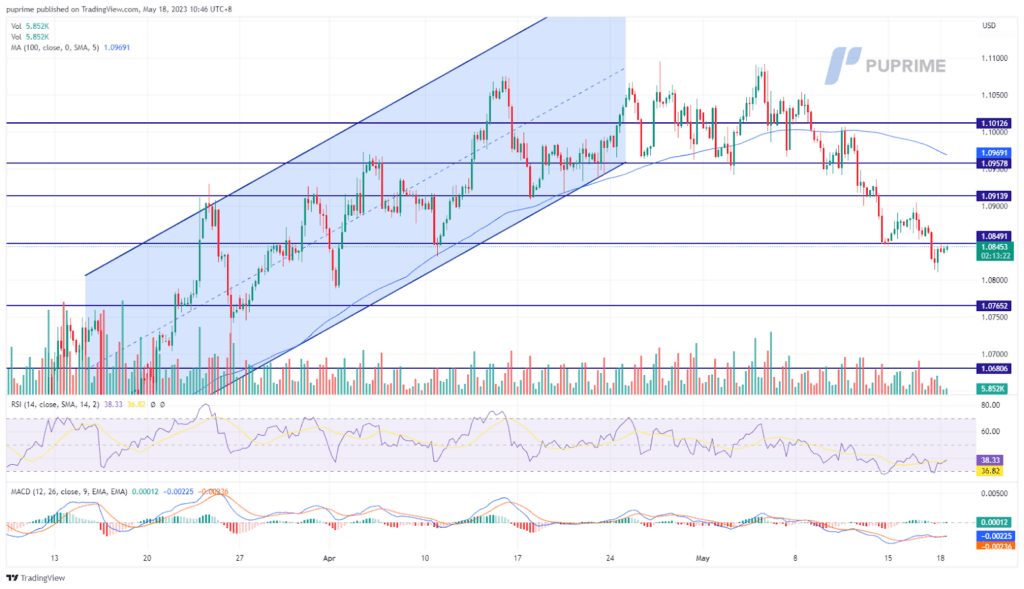

The euro continues to trade sluggishly and has broken below its crucial support level at 1.0850. The optimistic news from the U.S. federal government on meeting the consensus of a bipartisan agreement to avoid the U.S. default from happening has encouraged the dollar to trade higher. On the other hand, the EU CPI came higher than the previous reading up to 7% from 6.9%; and the ECB chair has reiterated that more than one interest rate hike is appropriate to tame stubborn inflation.

The euro continued to trade in its bearish channel in May. The RSI flows near to the oversold zone while the MACD flows flat below the zero line suggesting the pair is trading in a bearish momentum.

Resistance level: 1.0914, 1.0958

Support level: 1.0765, 1.0681

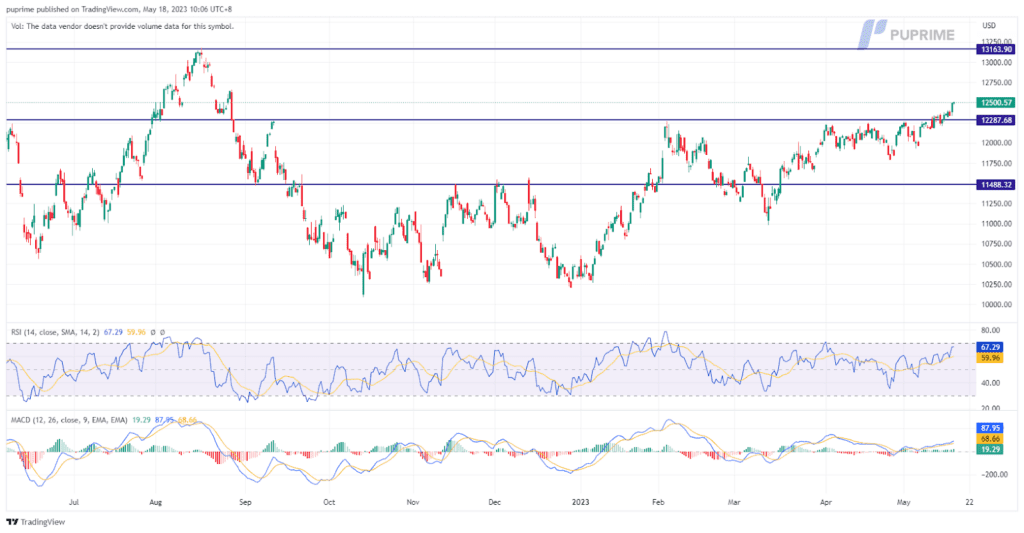

The Nasdaq Composite surged by 1.28%, gaining 157.51 points to 12,500.57 points. The rally was driven by optimism surrounding a potential agreement on raising the federal debt ceiling, alleviating concerns about a potential default. Additionally, a rebound in regional bank shares and a positive outcome from Tesla’s shareholder meeting contributed to the market’s positive sentiment. President Joe Biden and Republican leader Kevin McCarthy expressed their commitment to reaching a deal to avoid a detrimental economic outcome.

The index has continued its upward trajectory, remaining above the key support level and entering a bullish momentum. Technical indicators such as the MACD and RSI indicate a bullish outlook. This positive trend reinforces our previous prediction and suggests that the market sentiment remains optimistic. Investors are increasingly confident in the Nasdaq’s upward potential, buoyed by favourable market conditions. The sustained bullish momentum further strengthens the outlook for the index, potentially paving the way for further gains in the near future.

Resistance level: 13163, 14163

Support level: 12287, 11488

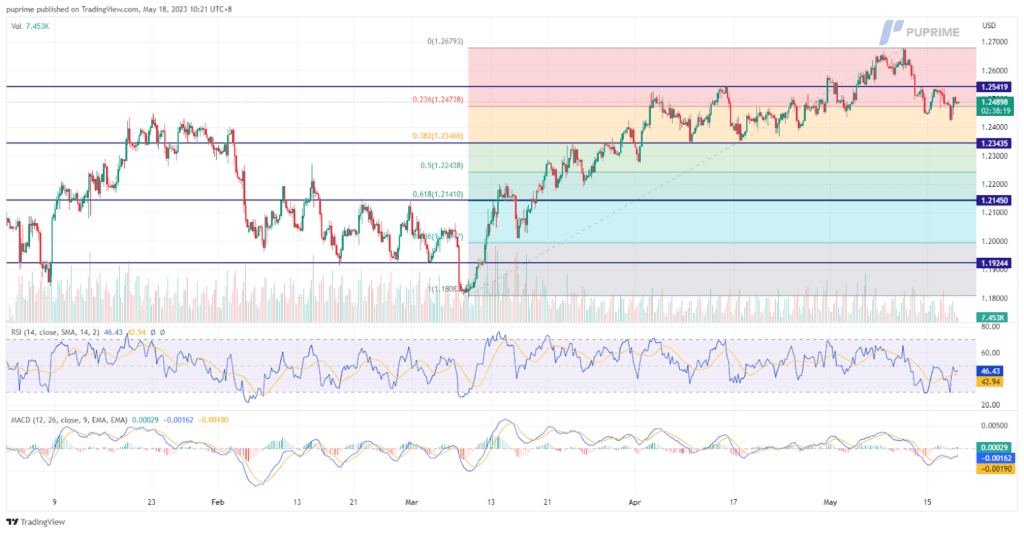

The pound experienced a decline against the resurgent US dollar on Wednesday and remained under pressure even after Bank of England Governor Andrew Bailey expressed expectations of easing price pressures by April. Bailey’s remarks, delivered at the British Chambers of Commerce Global Annual Conference, suggested that while a tighter monetary policy might be necessary if inflation persists, there were indications of a slight loosening in the labour market. Recent data revealing a rise in the UK’s jobless rate to 3.9% and steady growth in total pay, including bonuses, led some investors to scale back their expectations for future interest rate hikes. Future data releases, including April’s inflation figures next week, will be closely monitored to gauge the currency’s trajectory.

The pound is currently experiencing a period of neutral to slightly bearish price movement, indicating a possible technical correction in the currency’s value. While the current price movement may suggest a temporary subdue, market participants anticipate the pound will soon regain its upward trajectory.

Resistance level: 1.2540, 1.2680

Support level: 1.2345, 1.2145

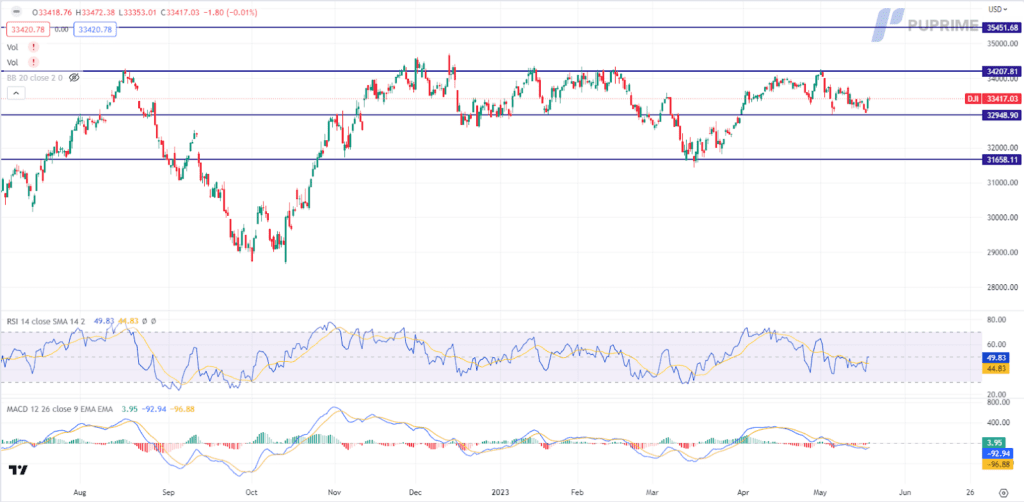

The Dow soared as hopes for successful debt ceiling negotiations and strong first-quarter earnings bolstered investor confidence. In Washington, the talks on raising the debt ceiling persist following a meeting between President Joe Biden and key lawmakers at the White House on Tuesday. As the deadline for a potential U.S. default looms closer, both sides are actively seeking common ground to avert such an outcome. This positive outlook continues to permeate the financial markets, with regional bank stocks experiencing a significant surge. Western Alliance Bancorp witnessed a remarkable surge of over 10% in response to their report of more than $2 billion in deposit growth for the quarter ending on May 12th.

The Dow is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 50, suggesting the index might trade higher as the RSI rebounded sharply from the overbought territory.

Resistance level: 34210, 35450

Support level: 32950, 31660

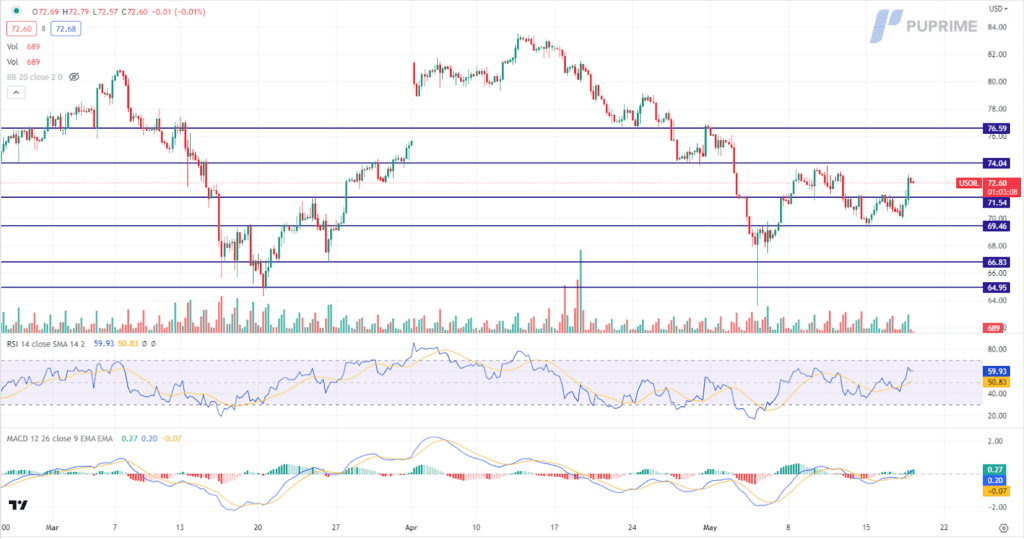

Oil prices made a significant rebound, with investors stepping in to buy the dip after the market touched a crucial psychological support level. Meanwhile, President Joe Biden’s optimistic remarks have played a role in boosting sentiment, as he expressed confidence in securing a higher debt ceiling through negotiations with Republicans in Congress before the weekend.

Oil prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 60, suggesting the commodity might extend its gains toward resistance level.

Resistance level: 74.05, 76.60

Support level: 71.55, 69.45

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

8 August 2023, 06:21 U.S. Equity Market Closes Higher Ahead of CPI

7 August 2023, 06:10 Dollar Softer After NFP Comes Short

4 August 2023, 06:20 BoE Delivers 25 BPS Rate Hikes Softening Pound Sterling

Nouvelles inscriptions indisponibles

Nous n'acceptons pas de nouvelles inscriptions pour le moment.

Bien que les nouvelles inscriptions ne soient pas disponibles, les utilisateurs existants peuvent continuer leurs défis et activités de trading comme d'habitude.