Inscrivez-vous au PU Xtrader Challenge dès aujourd’hui

Échangez avec du capital simulé et gagnez de vrais profits après avoir réussi notre évaluation de trader.

Inscrivez-vous au PU Xtrader Challenge dès aujourd’hui

Échangez avec du capital simulé et gagnez de vrais profits après avoir réussi notre évaluation de trader.

24 March 2023,06:23

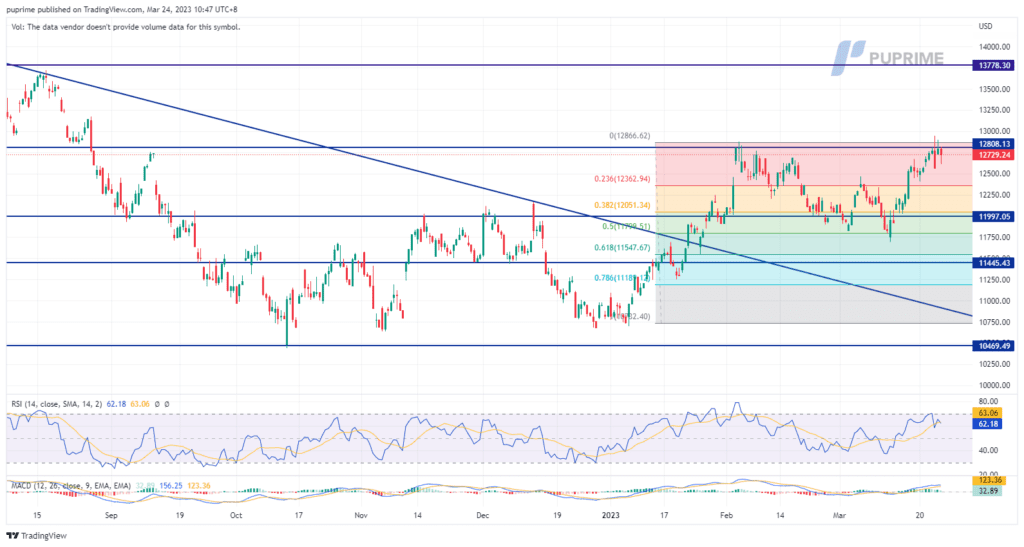

Daily Market Analysis

Wall Street was hindered by the banking sector and slumped after investors digested the comment from Janet Yellen, U.S. Treasury Secretary on Wednesday’s hearing. However, Yellen attempted to alleviate market concerns during a subsequent hearing on Thursday, promising that policymakers would take further action to safeguard bank deposits if necessary. Meanwhile, Japan’s inflation data indicates that consumer prices are on the rise, suggesting that the country is facing strong inflationary pressures. There is speculation that the newly appointed Japanese Governor may deviate from the current monetary easing policy. In contrast, the UK’s February CPI rebounded to double digits, yet the Bank of England (BoE) delivered only a modest 25 basis point rate hike yesterday, resulting in little change to the Pound Sterling last night.

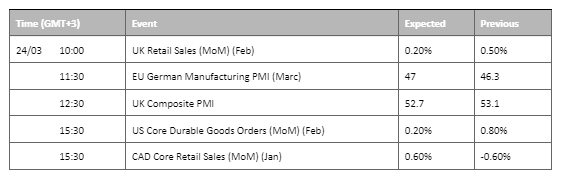

Current rate hike bets on 3rd May Fed interest rate decision:

0 bps (65.2%) VS 25 bps (34.8%)

The US Dollar has seen a remarkable surge, thanks to a series of optimistic economic data emanating from the United States. In an unexpected turn of events, applications for US unemployment benefits have continued to ease for a second consecutive week, providing further evidence of a labour market that remains taut. According to the Department of Labour, US Initial Jobless Claims have arrived at a better-than-anticipated 191K, comfortably surpassing the market’s projections of 197K. This report demonstrates the remarkable resilience of the labour market, despite the Federal Reserve’s interest-rate hikes over the past year.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 60, suggesting the index might extend its gains toward resistance level.

Resistance level: 103.50, 105.15

Support level: 102.00, 100.80

In a dramatic turn of events, gold prices surged to a historic high of $2,000 per troy ounce yesterday, as investors grappled with concerns over the potential impact of the Federal Reserve’s recent tightening decisions on the broader economy. Despite these fears, however, the gains experienced by gold prices were ultimately limited by a range of factors, including renewed demand for the US Dollar in the wake of upbeat jobless claims data. While the psychological significance of the $2,000 threshold cannot be overstated, market watchers remain cautiously optimistic about the outlook for gold prices in the near term.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 66, suggesting the commodity might enter overbought territory.

Resistance level: 2000.00, 2040.00

Support level: 1940.00, 1885.00

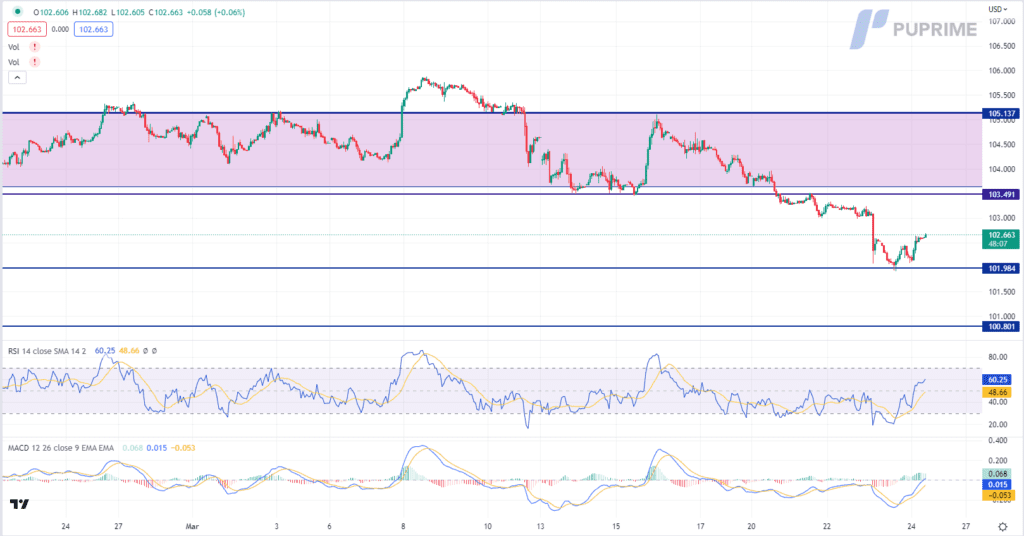

The euro’s five-session winning streak against the dollar ended yesterday, as the dollar experienced a technical rebound. The market sentiment has deteriorated, leading to a boost in demand for the safe-haven dollar. However, the banking sector crisis continues reverberating in the market, and the market perceives a relatively dovish stance from the Fed moving forward. In contrast, the European Central Bank (ECB) has sounded hawkish, and the market is anticipating a 50 basis point rate hike in May. Given the current situation, the euro appears to have the upper hand against the dollar.

In the H4 chart, the indicators depict a trend reversal for the pair. The RSI has fallen out from the overbought zone heading to the 50-level. The MACD on the other hand, has a convergence above the zero line, suggesting a bearish momentum is forming.

Resistance level: 1.0917, 1.0965

Support level: 1.0796, 1.0698

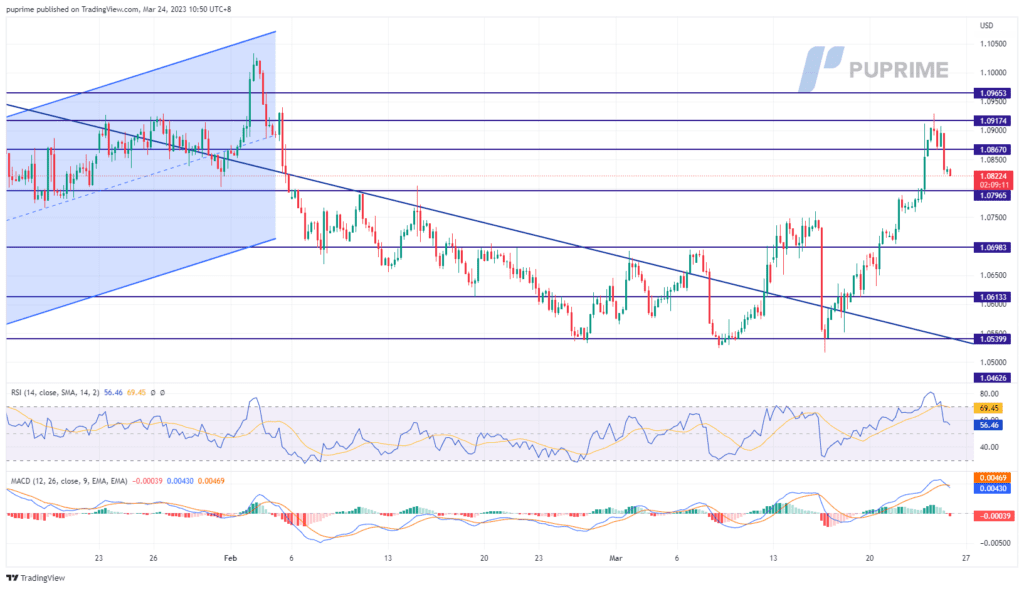

The Nasdaq index rose 1.29% to 12,729 points on Thursday, lifted by top technologies companies, including Apple Inc and Microsoft. Yellen’s positive turn also help to boost the Nasdaq index by providing confidence to the market. On the other hand, interest rate hikes by central banks around the world have stressed the banking sector. Furthermore, the overall market sentiment remains neutral-subdue as investors might worry about the impact of the Federal Reserve’s tightening decision. Therefore, investors are suggested to keep an eye on other economic data for a further catalyst to the market.

The index is testing its resistance level of 12800 points on Thursday. MACD has illustrated bullish momentum ahead. RSI is at 62, indicating a bullish momentum in the near term.

Resistance level: 12808, 13778

Support level: 11997, 11445

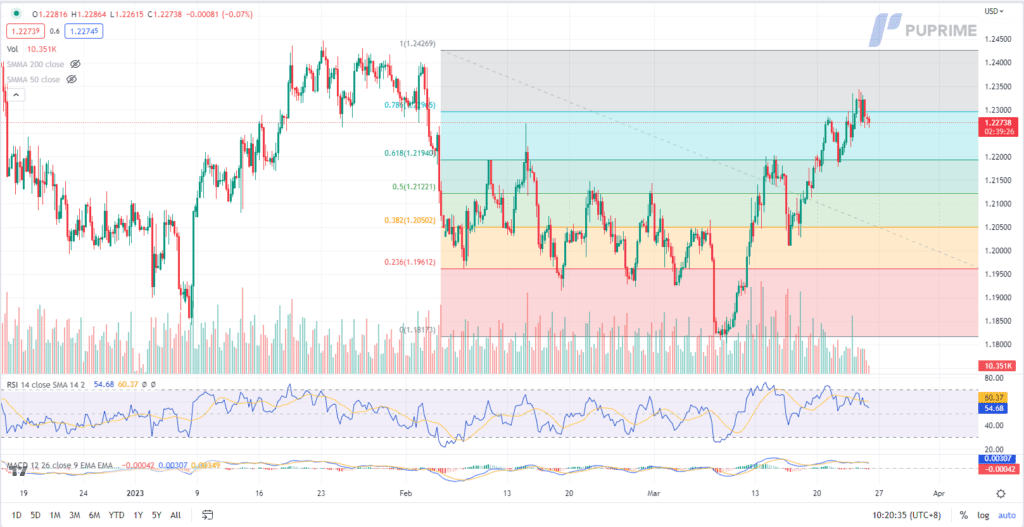

The Pound Sterling continues to stand on its ground, buoyed by the Bank of England’s decision to raise interest rates for the 11th consecutive time on Thursday. In a closely watched move, the BoE’s Monetary Policy Committee voted 7-2 in favour of a 25-basis point rate hike to 4.25%, in line with market expectations. While the Bank acknowledged the potential for inflation to fall sharply in the second half of the quarter, it also warned that further rate hikes may be necessary to maintain stable price growth. In fact, the BoE offered an upbeat assessment of the UK economy, revising its growth forecast for the second quarter to 0.40% on the back of fresh fiscal support measures and ongoing labour market strength.

GBPUSD is trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 55, suggesting the pair might experience technical correction since the RSI retreated sharply from the overbought territory.

Resistance level: 1.2295, 1.2425

Support level: 1.2195, 1.2120

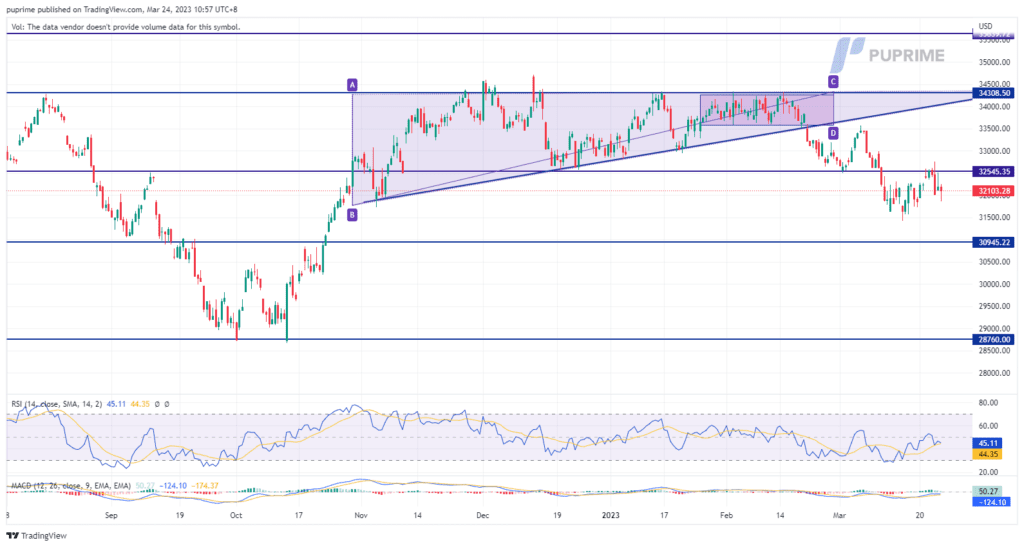

The Dow Jones Industrial Average rose 0.23% to 32105 points on Thursday after Yellen’s comment. She told the lawmakers the U.S. would protect deposits if needed, bolstering investors’ confidence. But the banking sector slumped and failed to benefit from Yellen’s comment. First Republic Bank dropped 6% in volatile trading in the wake of Yellen’s testimony. Furthermore, overall market sentiment remains neutral-subdue as investors worry the impact of the Fed’s tightening decision might tip the economy into recession. And investors are also leaning towards a pause from the Fed at the policy meeting in May. However, in an environment of uncertainty, investors are suggested to look for more economic data for further trading signals.

The Dow is trading on the sidelines at the moment. MACD has illustrated neutral-bearish momentum, while RSI is at 45, indicating a neutral-bearish momentum ahead.

Resistance level: 32545.00, 34310.00

Support level: 30945.00, 28760.00

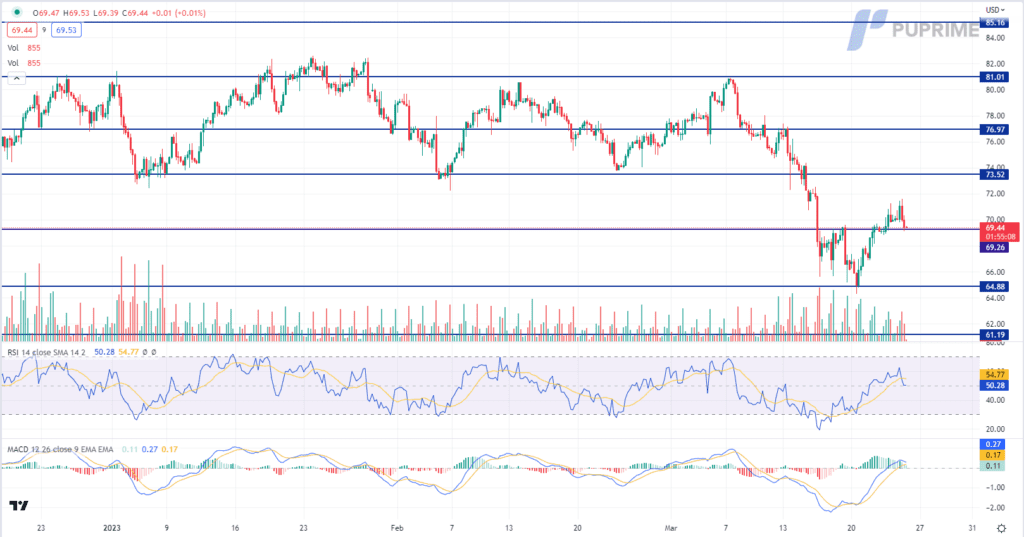

The robust US Dollar, buoyed by positive economic data, has remained a significant challenge for oil prices. Despite early gains, the value of oil took a dip yesterday, extending its losses. This downward trend has been further compounded by statements made by US Energy Secretary Jennifer Granholm during a recent Congressional hearing. Granholm cautioned that the process of replenishing the Strategic Petroleum Reserve (SPR) could take several years, thereby undermining the demand forecast for oil prices.

Oil prices are trading lower while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 50, suggesting the commodity might extend its losses since the RSI retreated sharply from the overbought territory.

Resistance level: 73.50, 76.95

Support level: 69.25, 64.90

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

8 August 2023, 06:21 U.S. Equity Market Closes Higher Ahead of CPI

7 August 2023, 06:10 Dollar Softer After NFP Comes Short

4 August 2023, 06:20 BoE Delivers 25 BPS Rate Hikes Softening Pound Sterling

Nouvelles inscriptions indisponibles

Nous n'acceptons pas de nouvelles inscriptions pour le moment.

Bien que les nouvelles inscriptions ne soient pas disponibles, les utilisateurs existants peuvent continuer leurs défis et activités de trading comme d'habitude.